Startups face challenges securing affordable fleet insurance due to limited resources and dynamic operational models. Insurers can attract startups by offering flexible, customized solutions like budget-friendly fleet insurance policies tailored to their unique needs, including unpredictable growth, fluctuating vehicle numbers, and diverse risk profiles. Strategic partnerships require clear communication and shared objectives, with startups providing detailed risk insights for insurers to offer competitive pricing through collaborative risk assessments. Comparing quotes from multiple insurers helps startups find the most affordable and comprehensive budget-friendly fleet insurance options available.

In today’s competitive landscape, startups require flexible and affordable solutions like budget-friendly fleet insurance to navigate risks and grow. Fostering partnerships with insurersthat understand startup needs is crucial. This article delves into the unique challenges faced by startups in securing fleet coverage, the incentives insurers find attractive in these partnerships, and offers practical strategies for building successful alliances to access cost-effective insurance options.

Understanding Startup Needs: Highlighting Unique Challenges for Fleet Insurance

Startups often face unique challenges when it comes to fleet insurance, requiring a tailored approach to meet their specific needs. These businesses typically operate with limited resources and have dynamic operational models, making it crucial for them to secure affordable coverage options. Budget-friendly fleet insurance is not just about minimizing costs; it involves understanding the startup’s evolving requirements and providing flexible solutions. Many startups struggle with unpredictable growth patterns, fluctuating vehicle numbers, and diverse risk profiles, all of which impact their insurance needs over time.

Insurers playing a supportive role in this context should offer policies that accommodate these fluctuations. This might include dynamic coverage options, customizable limits, and open communication channels to adjust policies as the startup scales or modifies its operations. By embracing these challenges, insurers can foster stronger partnerships with startups, ensuring they have the financial security needed to focus on growth and innovation rather than insurance complexities.

The Insurer's Perspective: What Makes Startups an Attractive Partnership?

From the insurer’s perspective, partnering with startups presents a unique and attractive opportunity. Startups often bring innovative ideas and disruptive technologies to the table, offering potential for growth and market expansion. They represent a forward-thinking segment of businesses that are quick to adopt new trends and digital solutions, aligning well with insurers’ aspirations to modernize their services.

Additionally, startups typically have distinct insurance needs, especially in sectors like technology and transport. For instance, budget-friendly fleet insurance is a common requirement for early-stage companies looking to keep operational costs low while ensuring adequate coverage. This niche need provides insurers with a specific area to offer specialized products, catering to startups’ unique challenges and fostering a mutually beneficial relationship.

Navigating Options: Budget-Friendly Fleet Insurance Solutions for Startups

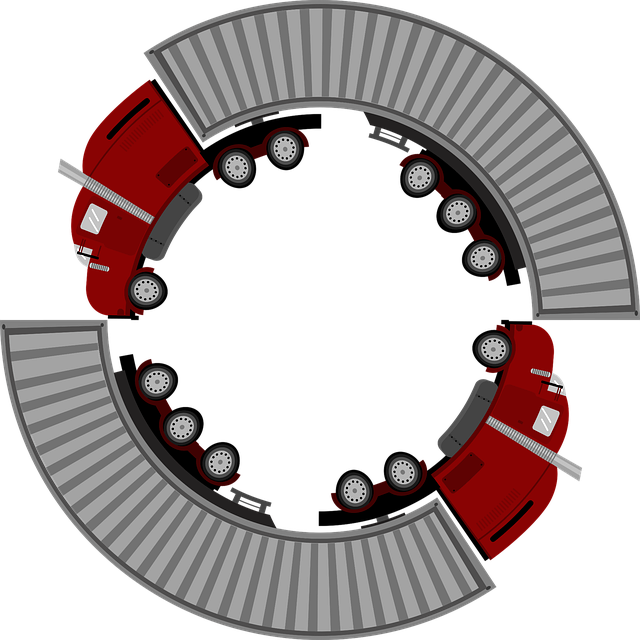

Navigating the complex world of insurance can be daunting for startups, especially when it comes to finding affordable solutions. Budget-friendly fleet insurance is a crucial consideration for young businesses looking to protect their assets and manage costs effectively. Many insurers now offer specialized packages tailored specifically for startups, making it easier to access competitive rates without compromising on coverage.

These options often include flexible policies that cater to the unique needs of emerging companies. Startups can opt for comprehensive fleet insurance that covers vehicles, drivers, and even business liabilities, all while keeping premiums within reach. By comparing quotes from multiple insurers offering budget-friendly fleet insurance, startups can identify the best value for their money, ensuring they have the right protection in place without breaking the bank.

Building a Successful Alliance: Strategies for Effective Collaboration

Building successful alliances with insurers is paramount for startups aiming to secure affordable coverage, like budget-friendly fleet insurance. Key to effective collaboration lies in clear communication and shared goals. Startups should approach insurers with a well-defined understanding of their risk profile and specific insurance needs, fostering transparency that builds trust. This includes outlining the business model, target market, and expected growth trajectory.

Insurers, likewise, benefit from proactive engagement with startups. Offering tailored solutions rather than one-size-fits-all policies demonstrates a commitment to understanding the unique challenges faced by burgeoning businesses, ensuring coverage aligns with their evolving needs. Regular check-ins, feedback sessions, and collaborative risk assessments strengthen this partnership, leading to more robust insurance options at competitive prices for startups seeking budget-friendly fleet insurance.

By fostering strategic partnerships with insurers offering startup-friendly, budget-friendly fleet insurance options, new businesses can navigate their unique challenges and access essential coverage at affordable rates. These collaborations empower startups to focus on growth while ensuring their operations remain protected. With the right alliance, it’s possible to create a sustainable and secure path forward.