In today's competitive market, businesses are turning to budget-friendly fleet insurance's pay-as-you-go model for flexibility and cost savings. By tracking driving habits, mileage, and vehicle utilization, insurers offer personalized rates that align with risk profiles. This real-time pricing structure eliminates fixed long-term commitments, allowing business owners to pay only for the coverage they need based on usage. Ideal for safe, efficient drivers, this approach can lead to lower insurance costs compared to traditional policies, providing both financial flexibility and control over expenses.

In today’s dynamic business landscape, flexibility is key. Exploring pay-as-you-go insurance options offers a revolutionary approach to fleet coverage, catering to businesses seeking budget-friendly solutions. This article delves into the benefits and mechanics of this modern insurance model. We’ll guide you through understanding pay-as-you-go insurance, its diverse policy types, and how it empowers businesses with flexible payments tailored to their unique needs, ensuring optimal cost management without compromising on coverage.

Understanding Pay-as-you-go Insurance: A Modern Approach to Fleet Coverage

In today’s dynamic business landscape, companies are increasingly seeking flexible and cost-effective solutions for their fleet operations, especially when it comes to insurance. Pay-as-you-go insurance emerges as a modern approach tailored to meet these needs, offering budget-friendly fleet coverage that aligns with the variable nature of many businesses. This innovative model deviates from traditional insurance policies by eliminating fixed, long-term commitments. Instead, it enables business owners to pay for insurance based on their actual usage and risk profile.

This paradigm shift is particularly advantageous for companies managing a fleet of vehicles, as they can now accurately allocate insurance costs according to specific vehicle utilization, miles driven, and driver behavior. By monitoring these factors in real-time, pay-as-you-go insurance providers can offer personalized rates, ensuring that businesses only pay for the coverage they truly need. This approach not only promotes financial discipline but also fosters a culture of responsible fleet management.

Benefits of Budget-Friendly Fleet Insurance for Businesses

For businesses with fleets, budget-friendly fleet insurance offers a range of advantages that can be instrumental in financial planning and risk management. This type of insurance provides flexibility, allowing businesses to align their coverage with their specific needs and financial capabilities. By opting for pay-as-you-go models, companies only pay for the specific risks they face, ensuring costs remain manageable without compromising on protection.

Moreover, budget-friendly fleet insurance can enhance operational efficiency by simplifying administrative processes. With transparent pricing structures, businesses gain better control over their expenses, enabling them to forecast and manage cash flow more effectively. This not only reduces financial strain but also fosters a culture of prudent risk assessment and responsible spending within the organization.

How Does Pay-as-you-Go Pricing Work? A Step-by-Step Guide

Pay-as-you-go insurance pricing is a flexible and modern approach designed to cater to the needs of today’s drivers, especially those with budget-friendly fleet insurance requirements. This model works by charging premiums based on actual usage rather than estimated risk factors. Here’s a step-by-step breakdown:

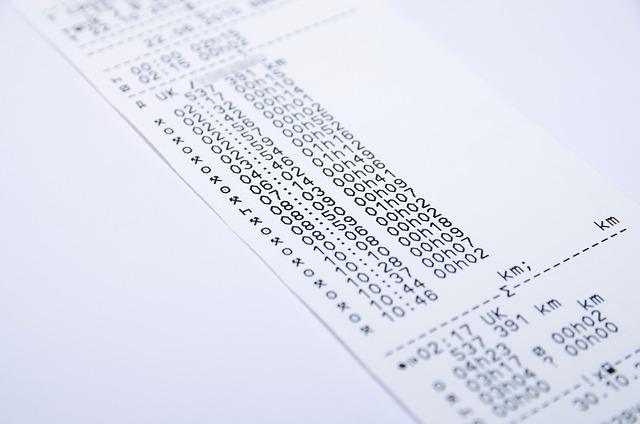

1. Installation of Tracking Device: The first step involves installing a device in your vehicle that tracks driving habits and miles traveled. These devices are typically small, secure, and provide real-time data.

2. Data Collection: Over time, the tracking device gathers data on your driving behavior, including speed, acceleration, braking patterns, and location. This information is then sent to the insurance provider.

3. Calculating Premiums: Using the collected data, insurers calculate your risk profile based on factors like safety, fuel efficiency, and driving consistency. Premiums are then adjusted accordingly. The more responsible your driving habits, the lower the premiums.

4. Automatic Billing: Premiums are billed monthly or quarterly based on usage, ensuring you pay only for what you drive. This system eliminates the need for estimated quotes and surprises at policy renewal time.

5. Potential Savings: One of the significant advantages is the potential for substantial savings. If you have a budget-friendly fleet with drivers who maintain safe and efficient driving habits, the pay-as-you-go model can result in lower overall insurance costs compared to traditional policies.

Exploring Different Types of Pay-as-you-Go Insurance Policies

When it comes to exploring pay-as-you-go insurance options, one of the most popular and flexible choices is budget-friendly fleet insurance. This type of policy is designed to cater to businesses with multiple vehicles, offering a scalable and cost-effective solution. The beauty lies in its adaptability; you can customize coverage based on your specific needs, driving down expenses for smaller fleets or individual drivers.

Different insurers provide various options within the pay-as-you-go framework, allowing you to select policies that align with your budget and risk profile. From comprehensive coverage to more tailored plans focusing on specific aspects like liability or collision, there’s a diverse range of choices. This approach ensures that you only pay for what you require, making it an attractive prospect for businesses seeking financial flexibility and control over their insurance costs.

In today’s dynamic business landscape, embracing flexible payment solutions like pay-as-you-go insurance is a strategic move for fleet management. This modern approach offers businesses, especially small and medium-sized enterprises, the freedom to manage costs effectively without sacrificing coverage. By understanding the various types of pay-as-you-go policies and their benefits, companies can navigate the insurance landscape with confidence, ensuring they’re protected while maintaining financial flexibility. Opting for budget-friendly fleet insurance is not just a cost-saving measure; it empowers businesses to adapt to changing circumstances, fostering growth and sustainability in an ever-evolving market.